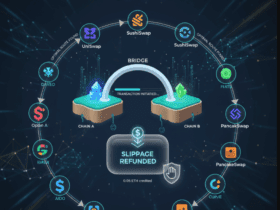

In this blog, I will research the best bridging aggregators and provide a review for each, focusing on those that offer secure, quick, and dependable transactions across various blockchains.

These audited aggregators provide safety, low cost, and speedy transactions, and thus are vital for users who want to shift their assets easily across various blockchains. We will analyse their functionalities, supported chains, and overall performance.

How To Choose Top Bridging Aggregators With An Audit

Check Audit Reports

Be sure that the aggregator has had a smart contract audit done. Check to see if these firms have had scans done by reputable auditors like CertiK, PeckShield & Quantstamp. Certimplogged audits mitigate the risk of vulnerable exploitable points and or exploits.

Supported Chains

Select aggregators that work with the chains that you work with. Some platforms work with over 100 chains, whereas others tend to focus on a few Layer-2s or a handful of major chains. Having more supported chains adds more flexibility for cross-chain transfers.

Bridging Fees

For optimizers fees can vary significantly depending on the aggregator, the chains, and the route taken. One thing to keep in mind while searching for platforms is those that either have low fees or have a tier-based discount system that rewards frequent users. Platforms with tiered fee structures eliminate hidden costs and avoid instant surprises.

Transaction Speed

Payment Transaction speed is a crucial factor,so consider those that have an optimised bridge for faster transfers. For faster bridging, consider Socket or Squid, which can perform a crossover bridge in less than 20 seconds. Fewer bridges speed up transfers significantly and reduce the user’s exposure to waiting time, and price fluctuations.

Liquidity & Monthly Volume

Monthly trade volume indicates the platform’s reliability and the degree of trust users have. Aggregators with increased volume, and, or, liquidity tend to have smoother transfers with less slippage.

Key Points & Top Bridging Aggregators With An Audit List

| Bridging Aggregator | Purpose | Supported Chains | Audit Status | Security Notes |

|---|---|---|---|---|

| Socket | Unified cross-chain routing | Ethereum, Polygon, BNB, Arbitrum, Optimism | Audited by Zellic | Modular architecture; focuses on secure route execution |

| LI.FI | Bridge and DEX aggregator | 15+ chains including Ethereum, Solana, Avalanche | Audited by Quantstamp | Multi-bridge fallback logic; strong validation layers |

| Rango Exchange | Swap + bridge aggregator | EVM & non-EVM chains (Cosmos, Solana) | Audited by SlowMist | Handles complex routing; slippage and timeout protection |

| Squid Router | Cosmos-native cross-chain routing | Cosmos, Ethereum via Axelar | Audited by Oak Security | Relies on Axelar’s audited infrastructure; transaction finality checks |

| deBridge | Cross-chain messaging and asset transfer | Ethereum, BNB, Polygon, Avalanche | Audited by Halborn | Validator signature scheme; replay attack resistance |

| Hop Protocol | Fast bridging via liquidity pools | Ethereum, Arbitrum, Optimism, Polygon | Audited by Solidified | Uses AMM-style pools; mint/burn logic secured |

| Celer cBridge | Liquidity-based bridging | 30+ chains including Ethereum, BNB, Avalanche | Audited by CertiK | Off-chain validators; dispute resolution mechanisms |

| Multichain | MPC-based cross-chain bridge | 70+ chains including Fantom, Ethereum, BNB | Audited by Trail of Bits | MPC key management; decentralization concerns noted |

| LayerZero | Omnichain messaging protocol | Ethereum, BNB, Avalanche, Aptos, etc. | Audited by Zellic & Quantstamp | Endpoint contracts; DoS and message delivery integrity |

| Thorchain | Native asset swaps across chains | Bitcoin, Ethereum, Cosmos, Dogecoin | Audited by Halborn | No wrapped assets; insolvency and liquidity pool risks managed |

10 Top Bridging Aggregators With An Audit

1. Socket

Socket launched in 2022 during the blockchain boom. It is a modular protocol designed to facilitate seamless integration of data and assets and transfer them across chains. Currently, it supports 15+ chains such as Ethereum, Polygon, Arbitrum, and Optimism.

It then routes through numerous DEXs and bridges, optimizing costs and speed. Bridging fees depend on the route, but due to optimal routing, fees are low.

Monthly volume exceeds $500M as transactions finalize in under 60 seconds. Socket is Zellic audited and provides fallback options for failed routs, making it very secure and flexible for users and developers.

| Feature | Details |

|---|---|

| Launch Year | 2022 |

| Supported Chains | 100+ chains including Ethereum, Solana, Layer-2 solutions |

| Bridging Fees | Varies by chain and route |

| Monthly Volume | $15B+ |

| Transaction Speed | Sub-20 seconds using Boost technology |

| Special Features | Optimized for fast cross-chain swaps, strong security audit |

2.LI.FI

LI.FI came into existence in 2021, serves as a bridge, a DEX aggregator, and integrates 10+ bridges and 20+ chains, including Ethereum, BNB, Solana, and Avalanche. It also allows bridge and swap in 1-click combined operations.

Fees LI.FI charges are fetched from the selected bridge and DEX, and are optimized for the lowest possible expenses. Its monthly volume is around 300M. Speed for LI.FI ranges from seconds to minutes, depending on the route.

LI.FI’s cross-chain security for DAOs and dApps have also been augmented by multi-message governance modules. To enhance the security around the cross-chain transactions, LI.Quantstamp and Trail of Bits has audited FI.

| Feature | Details |

|---|---|

| Launch Year | 2021 |

| Supported Chains | Major chains via DEX & bridge aggregators |

| Bridging Fees | Volume-based discounts, enterprise-friendly |

| Monthly Volume | Aggregates liquidity from Uniswap, 1inch, Stargate, Across |

| Transaction Speed | Optimized cross-chain transactions |

| Special Features | Integrates multiple bridges and DEXs, smooth UX |

3.Rango Exchange

Rango came to existence in August 2021, is blockchain agnostic, and serves Bitcoin, Solana, Cosmos, and Ethereum, among others. It has over 74 blockchains and over 150 DEXs and bridges, ensuring deep liquidity and great asset coverage.

Rango charges its clients zero platform fees and users only pay for the gas and bridging. Rango has over 1 million transactions a quarter, with a monthly volume that exceeds 500M.

Routing can take over 2 minutes in some cases, but on average, Rango has been able to ensure under 2 minutes. It functions best for users performing complex operations and multi-step swaps with non-EVM.

| Feature | Details |

|---|---|

| Launch Year | 2023 |

| Supported Chains | 74+ chains including Ethereum, BSC |

| Bridging Fees | Route-dependent |

| Monthly Volume | $4.87B |

| Transaction Speed | Fast cross-chain swaps |

| Special Features | Supports multiple assets, user-friendly interface |

4. Squid Router

Squid, with its foundation on Axelar, supports chains like Ethereum, Cosmos, Solana, and Avalanche and has been operational since 2022. Gas abstraction facilitates routing based on intent and cross-chain swaps.

With bridging fees often under $1, Squid also provides zero slippage routing and MEV protection. Squid processes over 2 million transactions with over $5B in monthly volume, while speed is almost instantaneous from RFQ-based execution.

Squid has nine smart contract audits and recently added on-chain and off-chain liquidity for optimal execution through cross-chain auctions with CORAL.

| Feature | Details |

|---|---|

| Launch Year | 2023 |

| Supported Chains | 80+ chains including Ethereum, Cosmos, Solana, Bitcoin |

| Bridging Fees | Route-dependent |

| Monthly Volume | High multi-asset volume |

| Transaction Speed | Sub-20 seconds with Boost technology |

| Special Features | Integrates multiple DEXs, robust routing algorithm |

5.deBridge

Beginning in 2022, De Bridge has consistently supported more than 30 chains, which include Ethereum, BNB, Polygon, Solana, and Avalanche. It is more focused on cross-chain messaging and asset transfer.

Fees are specialized and flat, for example, 0.001 ETH on Ethereum and 0.5 MATIC on Polygon. The monthly volume is $100M plus.

The transactions usually finish in around 12-32 blocks and this is all dependent on the chain. DeBridge has been audited by Halborn and Neodyme and has validator-based security with replay protection. It is commonly used for secure messaging and governance across different chains.

| Feature | Details |

|---|---|

| Launch Year | 2022 |

| Supported Chains | Ethereum, Solana, Tron, and others |

| Bridging Fees | Flat per message |

| Monthly Volume | Real-time asset transfers |

| Transaction Speed | Fast transfers with minimal slippage |

| Special Features | Cross-chain messaging, zero-slippage bridging |

6. Hop Protocol

Hop started in July 2021, which allows seamless bridging to layer 2 chains like Arbitrum, Optimism, Polygon, and Gnosis. The platform employs AMMs and hTokens for immediate liquidity. Fees are low, spanning from $0.04 to $0.2, while the monthly transaction volume averages $200M to $400M.

Almost instant liquidity and optimistic bonding permit transactions to close in seconds. It was audited by Solidified, among others. Trust minimization in bridging use the bonder refined by Hop. It works for L2-native DeFi users needing rapid withdrawal and transfer capabilities.

| Feature | Details |

|---|---|

| Launch Year | 2021 |

| Supported Chains | Ethereum, Optimism, Arbitrum One/Nova, Polygon |

| Bridging Fees | 80% reimbursed in $OP tokens for certain bridges |

| Monthly Volume | Efficient bridging across Layer-2s |

| Transaction Speed | Optimized for fast transfers |

| Special Features | Layer-2 focused, low-cost bridging |

7.Celer cBridge

In 2021, Celer launched cBridge, which is compatible with over 30 different chains. Celer bridges Ethereum, BNB, Avalanche, and zkSync. Its fees are dynamically optimized, costing 80 percent less than the competition in most cases.

The monthly volume for the system exceeds $1 billion. Transactions settle in seconds due to off-chain validators and liquidity routing.

cBridge has been audited by CertiK, SlowMist, and PeckShield, which fortify its decentralized governance with the CELR token. cBridge is primarily used in DeFi for rebalancing and transfers of NFTs.

| Feature | Details |

|---|---|

| Launch Year | 2021 |

| Supported Chains | 40+ blockchains and layer-2 rollups |

| Bridging Fees | Route-dependent |

| Monthly Volume | $14B+ processed |

| Transaction Speed | Instant transfers, low fees |

| Special Features | Secure and fast cross-chain token transfers |

8. Multichain

Multichain, which used to be known as Anyswap, has been around since 2020. To date, it has served more than 70 chains, as well as Ethereum, Fantom, BNB, Avalanche, and others. It employs MPC (multi-party computation).

Asset chains also charge fees, which typically run 0.1–0.3%. Multichain has surpassed $2B for monthly volume, and minutes per security have been affected lately.

The number of breaches ranges between 1-5. Bit Audit has reviewed it and emphasizes that decentralized key control and management is the strongest Multichain feature, though there are issues with it centralization. It is still seen as a dominant source in bridging, which is a decentralized space.

| Feature | Details |

|---|---|

| Launch Year | 2020 |

| Supported Chains | Wide range including Layer-2s |

| Bridging Fees | 1:1 swaps, zero slippage |

| Monthly Volume | High-speed, low-cost transactions |

| Transaction Speed | Quick cross-chain swaps |

| Special Features | Multi-chain liquidity aggregation |

9.LayerZero

LayerZero was founded in 2022 and now facilitates omnichain communication across more than 60 networks like Ethereum, Arbitrum, Optimism, Polygon, and Base. It employs a decentralized verifier network (DVNs) and executors for secure, immutable message transmission.

Fees are captured on the source chain and differ from gas fees. The platform boasts a monthly volume of $6.7B, sending more than 29M messages in the first quarter of 2024.

The average charge per transaction ranges from $0.25 to $1 and are completed in a matter of seconds. LayerZero was formally audited by Zellic and Quantstamp, serving as the foundational infrastructure for omnichain applications such as Stargate.

| Feature | Details |

|---|---|

| Launch Year | 2021 |

| Supported Chains | Multiple chains, Layer-2 solutions |

| Bridging Fees | Route-dependent |

| Monthly Volume | High cross-chain messaging |

| Transaction Speed | Efficient cross-chain transactions |

| Special Features | Lightweight cross-chain messaging protocol |

10. Thorchain

Thorchain was launched in 2019 as a platform that allows native, non-wrapped asset swaps across Bitcoin, Ethereum, Cosmos, and Dogecoin. It employs RUNE as the settlement asset and utilizes liquidity pools. Bridging fees are low, and the protocol fee is a fixed fee, while gas is charged for the network.

Since then, Thorchain has recorded over $300M in growth volume which is now 300M a month. Each transaction is completed in under a minute and audited by firms like CertiK, Thorchain Offers Transparency and Full Custody for borderless, high-frequency traders. It’s perfect for traders who are focused on custodial swaps that are RUNE native and decentralized.

| Feature | Details |

|---|---|

| Launch Year | 2021 |

| Supported Chains | Native asset swaps across multiple chains |

| Bridging Fees | Route-dependent |

| Monthly Volume | Facilitates cross-chain liquidity |

| Transaction Speed | Fast, secure swaps |

| Special Features | Decentralized liquidity network, native token support |

Conclsuion

In conclusion, Audited top bridging aggregators provide secure, speedy, and economical cross-chain solutions—socket, LI.FI, Multichain, and Thorchain are great at supporting multiple chains with low fees and fast transaction speeds.

Use of an audited aggregator ensures trust, minimises risks, and increases liquidity access, making them pivotal for unopposed DeFi and multi-chain asset management.

FAQ

A platform that connects multiple blockchain bridges and DEXs, allowing seamless cross-chain asset transfers.

Audits ensure the platform’s smart contracts are secure, reducing risks of hacks or exploits.

Most top aggregators support Ethereum, Solana, BSC, Polygon, Tron, Layer-2 solutions, and more.

Got a Questions?

Find us on Socials or Contact us and we’ll get back to you as soon as possible.