In today’s world of DeFi, obtaining bridging aggregator analytics for trading bots is vital for success. These analytics provide bots with vital information on transaction volumes, fees, liquidity, and cross-chain price variations, enabling quicker, smarter, and risk-free dealings.

Extracting useful strategies from on-chain data translates into improved trading performance. This translates into greater competitive advantage and risk mitigation of traders from DeFi cross-chain markets.

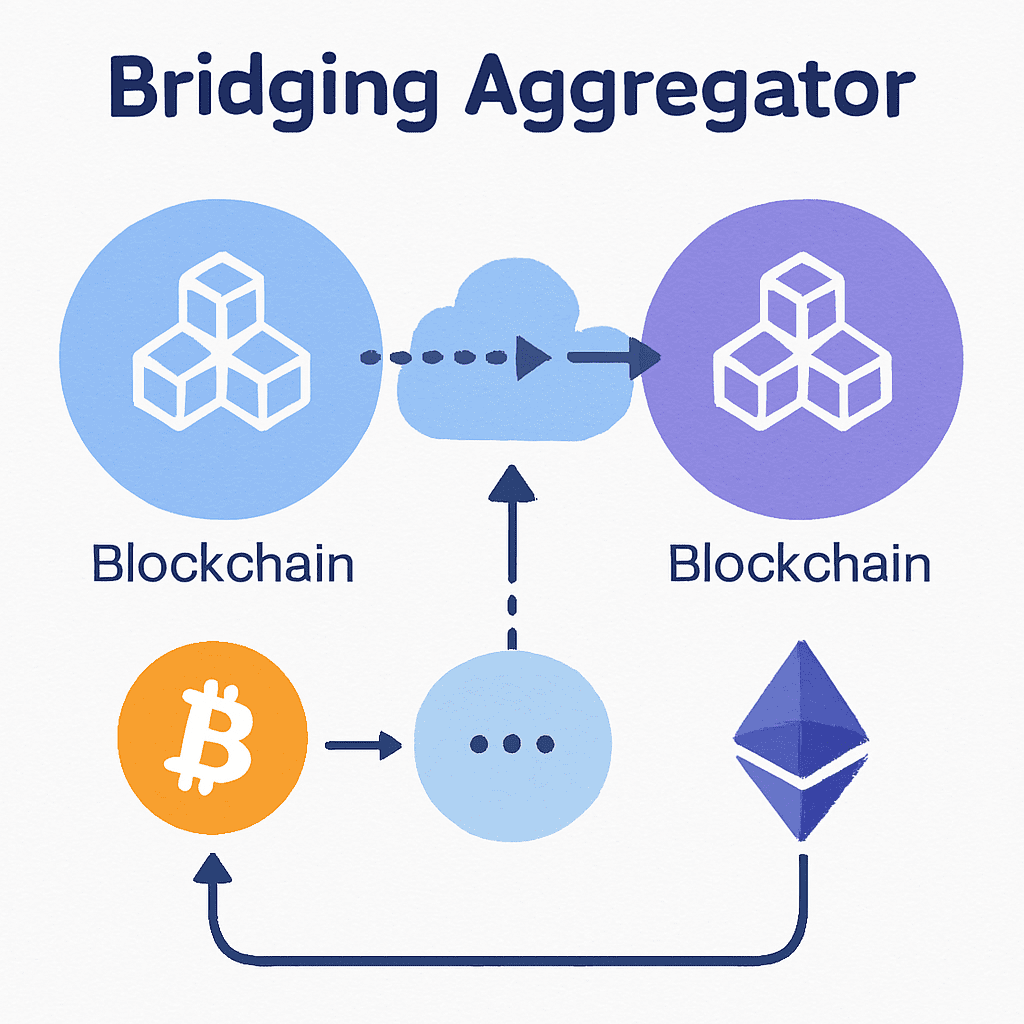

Understanding Bridging Aggregators

Bridging aggregators optimize transaction routing to simplify the movement of tokens within disparate blockchain networks. In DeFi, these aggregators improve UX by simplifying processes, enabling cross-chain functionality, and providing vital tools that traders can use to develop strategies.

Key Analytics to Extract

Bridging aggregators facilitate the transfer of tokens between different blockchains by finding the best paths for transactions. In the self-governing segment of finance, it simplifies operations, allows cross-chain interactions, and provides necessary data for users to create efficient trading plans.

Transaction Volume

Monitoring transaction volume across different bridge aggregators can help determine which routes are the most dependable and used. High volume indicates trust and efficiency while low volume indicates lack of adoption and liquidity risks. Traders use this data to determine which bridges are reliable for large cross-chain operations.

Fee Structures

Analyzing various fee structures is crucial for ensuring maximum profitability. Aggregators might have flat fee models, percentage-based charging structures, or both. This knowledge ensures that traders spend less and profit more by optimizing transactions which is crucial for automated trading bots that do cross-chain transfers on many blockchain networks.

Success Rates

Evaluating success transaction success rates ensures efficiency by monitoring utilization and eliminating wasted time and the capital of failed trades. High success rates signal reliable bridges while low success rates signal broken bridges. Stable traders build routes around bridges so that risks are lowered and performance is maximized.

Liquidity Metrics

Liquidity metrics track how much capital sits in bridges and how much of it can be used to execute trades without any slippage. High liquidity will allow you to execute much larger transfers with stable prices but low liquidity can create volatility. Keeping an eye on these numbers will help ensure cross-chain strategies still work in dynamic markets without losing money.

Cross-Chain Price Differences

With price differences on blockchains, you can find opportunities for arbitrage. Traders can make profit by reconciling the prices of a token in different networks. Aggregators with real time analytics help pinpoint these discrepancies so bots and manual traders alike can take advantage of it before the rest of the market catches on. This assists in arbitrage trading that’s driven by data.

Tools and Methods for Extraction

APIs

APIs from bridging aggregator provide data on transactions, fees, and liquidity in real time. Developers interested in monitoring transactions through the Rango and LI.FI platforms can use the Direct Integration feature. Traders can use these APIs to develop analytics dashboards for assessing bridges, discovering arbitrage trades, and developing trading strategies.

Custom Development

Traders can automate the process of preforming analytics with custom trading bots and scripts. These tools can analyze liquidity, fees and transactions while monitoring for alerts. Automation helps improve speed of operations, reduces the manual work needed, and allows traders to make real time decisions.

Monitoring Tools

Monitoring solutions assist in performance evaluation of bots and aggregators. Tools send alerts concerning failed trades, capricious fees, and liquidity drops, allowing users to take a proactive stance. Monitoring performance in real time saves users time and lowers risk, driving profits in a risk-averse model and ergonomic cross-chain, continually optimized through data approaches.

Benefits of Analytics for Traders

Decision Making

Real-time Vox analytics allow traders to saavy liquidate a transaction’s volume. Having understanding on what bridge to use on a route is. Also being able to understand bridge efficiency drastically helps improving outcomes and really eases the guesswork needed to come to a conclusion.

Risk Management

Trading bridge liquity and success rate analytics is what helps understand what bridges are success ratio unlocked and easy to move on cross-chain. Not losing the attempt on closing the transaction and minimizing the funds wasted on failing attempting to entice a bridge puts the traders in the winning zone.

Arbitrage

The narow fee,highly liquid route gives the trader the ability to really capture the profit bridge by bridge. Having special trading bots really helps to solve the problem of cross analytics and profit computation and manual traverse across differential pricing blockchains for optimized trading.

Size

Traders are able to use their own strategies on multiple networks at the same time to capture the profit funneling them in for maximum efficiency without losing any time for manual labor trading. They are bailed out of worrying about domainse perplex speed and available precision.

Winning the Competition

Analytics systems enable traders to gain competitive edge by revealing aspects of the market that may not be obvious at first glance. Data-driven strategies improve bottom lines by closing arbitrage gaps and other market inefficiencies. Traders maintain competitiveness in the rapidly changing DeFi market by continuously addressing market inefficiencies.

Future of Bridging Aggregator Analytics

- AI-Driven Route Optimization – Route optimization will be accomplished with machine learning by projecting the fastest, most affordable, and most dependable paths for cross-chain transactions.

- Standardized API Frameworks – For easier data retrieval and integration, consolidated APIs will be implemented by aggregators for standardized API use.

- Predictive Liquidity Analytics – Slippage will be minimized by predicting and avoiding liquidity deficits.

- Security & Risk Scoring – Bridge analytics will monitor and evaluate real-time analytics for reliability, revealing weaknesses with the most substantial risk.

- Cross-Chain Arbitrage Expansion – Improved tools will discover additional price differentials on expanding multichain ecosystems.

- Automation & Smart Bots – For self-sufficient decision-making, trading bots in the near future will be capable of using predictive analytics for autonomous decision-making.

- DeFi–CeFi Integration – For more expansive strategy implementations, centralized analyzers will be cross chained with aggregators for deeper analytics integration.

Challenges and Risks

Security Vulnerabilities

Bridging aggregators are multiple network participants and smart contracts, making them opportunities for exploitable systems. One weakness can result in catastrophic outcomes.

Traders are liable when analytics don’t recognize wrong routing, which reiterates the importance of prevention systems and risk analytics for safe cross-chain operations.

Data Reliability

Real-time and precise information is essential for devising analytics. Stale information APIs, slow synching, and precision in devises results are information disorder, which can produce misconstrued and damaging trading tactics.

Bridging aggregators operate in ‘’sandboxed’’ DeFi systems to capture the frightened wolves, and cross-chain systems with unvetted APIs.

High Transaction Costs

Cross-chain activities are layered with multiple aggregated payments and network gas, which results in insidiously high operational costs. These can serve as underlying, unaccounted values in profit deducing flows.

Traders perform risk-exposing movements that can hollow balances without trace, as multiple values get crossed for simple trade efficiency.

Liquidity Constraints

Low liquidity in some some bridges can result in failing or stalling transactions. Additionally, sudden liquidity drains can lead to slippage or unfinished trades, no matter how thorough the calculations are.

Traders are in a state of capital inefficiency, all while using predictive capabilities simply to avoid a liquidity bottleneck in these unstable DeFi markets.

Regulatory Uncertainty

Cross-chain aggregators function in a multitude of different regions. Therefore, new regulations might change a traders’ ability to access certain data, use certain bridges, or even perform certain transactions.

Regardless of the calculations, noncompliance can result in traders blindsided by certain restrictions. Clarity concerning non-custodial protocols is one of the most fundamental issues in the realms of adoption and stability.

Conclusion

Analyze bridging aggregator analytics to determine their impact on building efficient and cost-effective trading bots for decentralized finance. Traders determine their strategies by analyzing transaction volume and major indicators like fees and liquidity, success rates, and cross-chain prices.

Predictive signals generated by APIs, bespoke software, and monitoring indicators systematize data streams, enhancing execution and risk management.

While data gaps, regulatory uncertainties, and system vulnerabilities pose robust challenges, profit potential, hyper-automation, seamless execution, and minimized diversification control justify deploying risk management on these analytics.

In the future, AI analytics, liquidity secrets, and enhanced security will transform cross-chain trading. From traders’ perspectives, using bridging aggregator analytics goes beyond making their analytics competitive; it enables vast, steady returns in the hyper-growing multi-chain DeFi world.

FAQ

Bridging aggregators connect different blockchain networks, selecting the most efficient routes for token transfers. They simplify cross-chain transactions by analyzing fees, liquidity, and reliability.

Analytics provide data on transaction volume, fees, success rates, and price differences. This helps trading bots make informed decisions, optimize profits, and reduce risks.

Traders should track transaction volume, fee structures, liquidity metrics, success rates, and cross-chain price discrepancies. These metrics reveal reliable routes and profitable opportunities.

Data can be extracted using APIs from platforms like Rango or LI.FI, custom scripts, or real-time monitoring tools designed to track performance and alerts.

Challenges include security risks, unreliable data feeds, liquidity shortages, high transaction costs, and evolving regulatory uncertainties in cross-chain environments.

Got a Questions?

Find us on Socials or Contact us and we’ll get back to you as soon as possible.