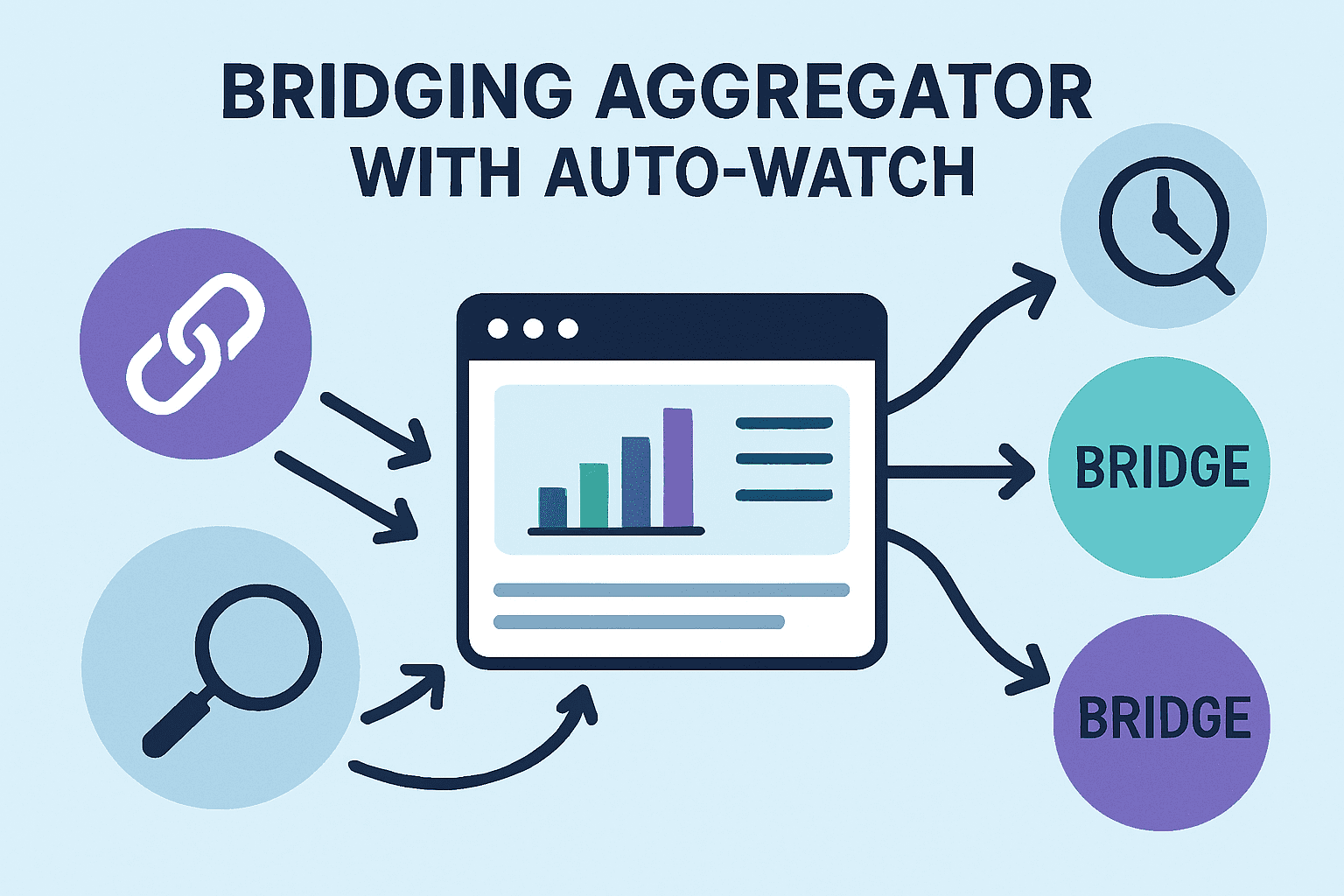

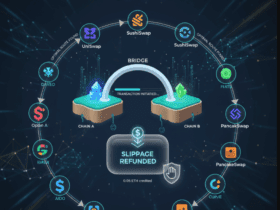

This article will cover the Bridging Aggregator with Auto-Watch Settings is a tool that enables users to move their assets through Bridging multiple blockchains at once while keeping the cost and time minimal.

The user is able to track their transaction in real time while the tool handles intricate details such crypto safe transfers.

The Auto-watch functions only allows user to forget the details and still manage in cross-chain user transactions.

How To Choose Bridging Aggregator With Auto-watch Settings

Supported Chains

Find out which blockchains the aggregator allows. The more supported chains there are, the more flexibility you have in moving the assets.

Liquidity and Transaction Speed

Faster transfers, low slippage. Route-optimizing aggregators speed up the transfer

Fees (Transaction, Maker and Taker)

Each bridge has its fee structure. Some platforms have a discount policy on transaction fees for holders of the platform’s native token.

Auto-Watch Feature

Make sure the aggregator has real-time-tracking of transactions. The risk of a transfer failing, being delayed, or being executed sub-optimally is minimized with auto-watch, and notifications are immediate.

Security and Reputation

Check the reviews, the audits, and what the community says. The chance of losing the funds on the bridge’s account is lower with stronger security platforms.

Key Point & Deatiled

| Platform | Key Features |

|---|---|

| Connext | Non-custodial, modular bridging, supports xApps, fast liquidity transfers. |

| Celer cBridge | Low fees, fast transfers, liquidity pools, multi-token support. |

| Layer3 Bridge | Incentivized cross-chain tasks, community quests, rewards-based transfers. |

| Rubic | Aggregates bridges + DEXs, one-click cross-chain swaps. |

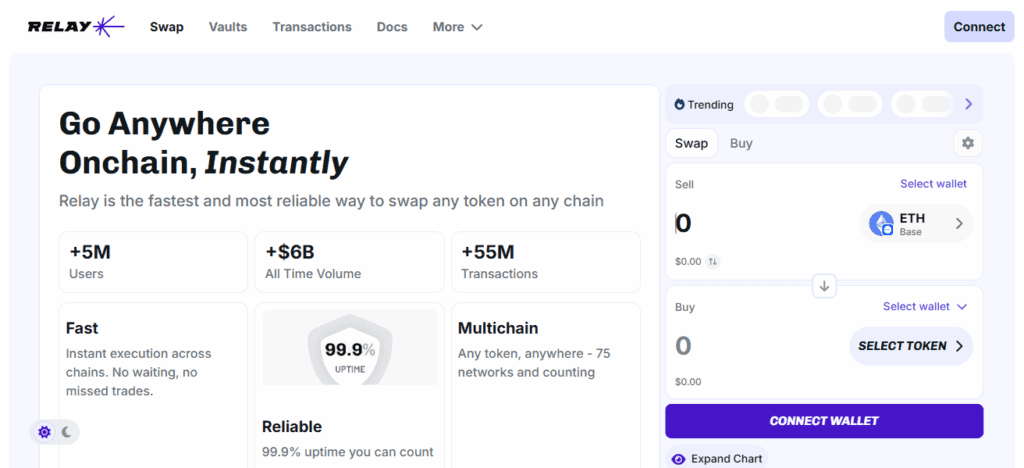

| Relay Chain | Fast token transfers, multi-chain liquidity incentives. |

| MetaMask Bridges | Integrated inside MetaMask wallet, compares bridge routes, simple UX. |

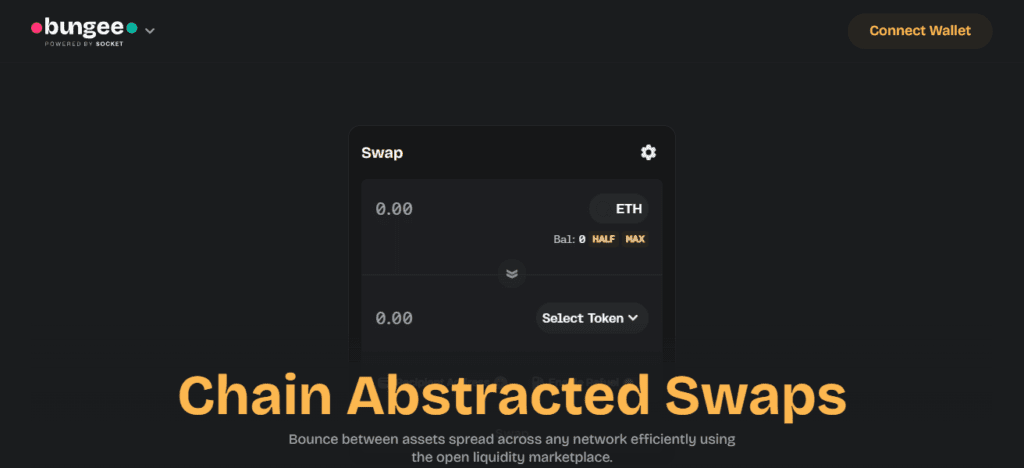

| Bungee Exchange | Smart routing for bridges + swaps, powered by Socket. |

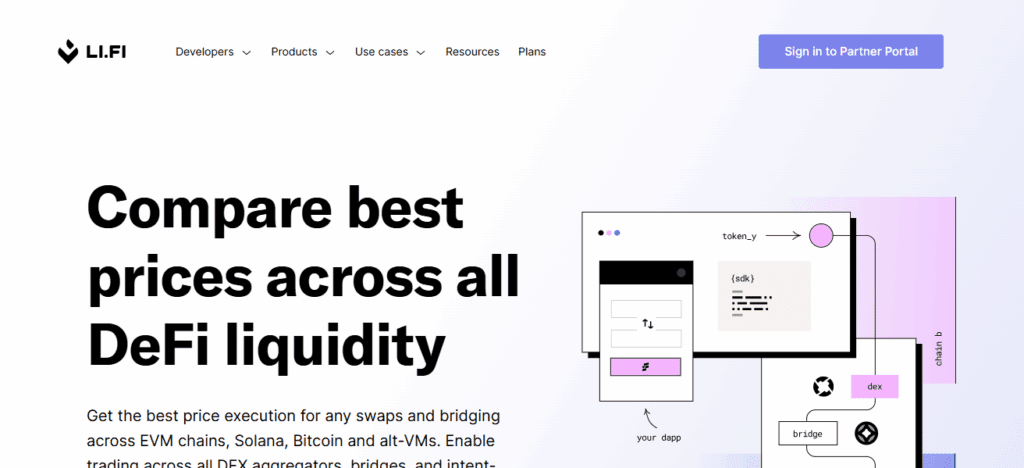

| LI.FI | Developer SDK + API, aggregates 20+ bridges & DEXs. |

| ChainARQ | Security-focused bridging with arbitration layer. |

| OKX DEX Aggregator (with deBridge) | Cross-chain swaps with OKX liquidity + deBridge interoperability. |

10 Bridging Aggregator With Auto-watch Settings

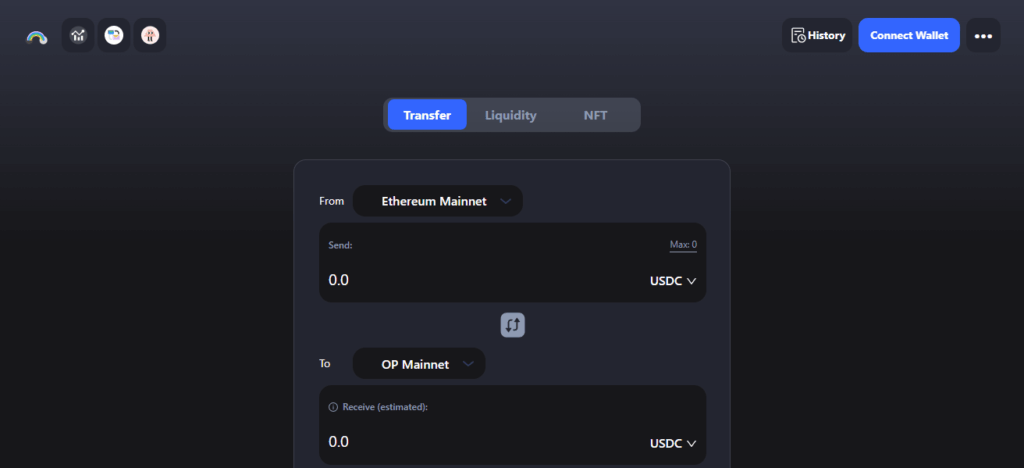

1. Connext

Connext Bridging Aggregator aims to facilitate cross-chain transactions by enabling cross-chain asset transfers with minimum hassle and blockchain transfers with ease.

Users get optimal routes with reduced fees and faster execution because it is a one-stop-solution that pools liquidity from multiple bridges.

Another unique offering to users is the auto-watch settings which enables users to track transactions with live updates on the completion status, facilitating the notification in case of misses.

The ease of confirming transactions and the visibility of the network are both improved. Enjoy smoother and safer bridging anywhere in the decentralized world with Connext.

| Pros | Cons |

|---|---|

| Fast and reliable cross-chain transfers | Limited to supported chains |

| Low fees compared to some competitors | Not ideal for very large transfers |

| Strong developer and community support | Fewer advanced features for beginners |

2. Celer cBridge

Celer cBridge is one of the first bridging aggregators that allows for fast, secure, and cost-effective cross-chain transfer of assets.

Its multi-chain architecture optimizes routes and liquidity to provide users with the most cost-effective transfer rates.

The custom auto-watch settings are one of the primary reasons users monitor the movement of their transactions and receive instant notifications on the status.

This increases user visibility and management, minimizes cross-chain transfer failures and delays, provides proactive and simplified management.

With Celer cBridge, users are guaranteed reliable, user-friendly and instant bridging capabilities which makes it one of the primary cross blockchain network assets transfer tools.

| Pros | Cons |

|---|---|

| High liquidity for multiple chains | Slightly higher fees on some chains |

| Multi-chain support | Network congestion can occasionally delay transfers |

| Auto-watch settings for real-time tracking | Interface may be complex for beginners |

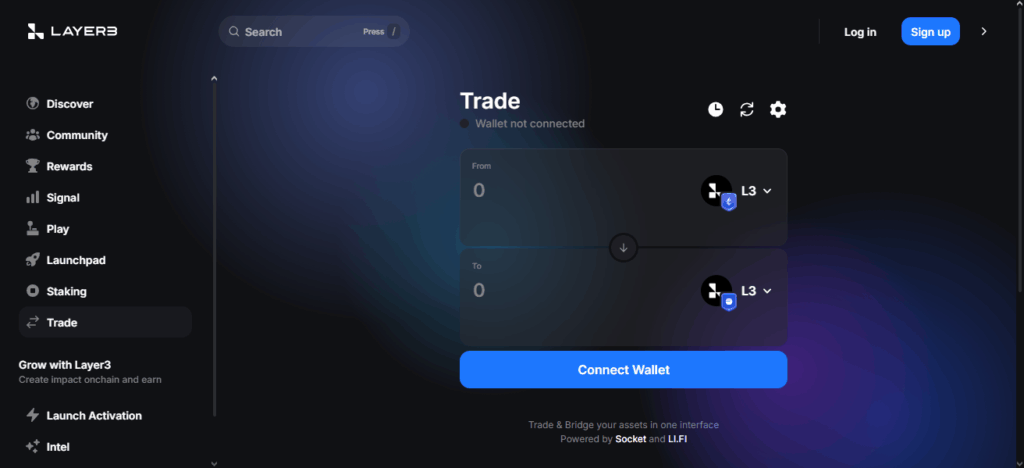

3. Layer3 Bridge

Cross-chain transactions are secured, fast, and efficient with Layer3 Bridge’s bridging aggregator innovation.

This brings competitive bridging liquidity with the lowest price and fast transfer capabilities by connecting multiple blockchains.

One of the features that distinguishes Layer3 is the auto-watch settings, which enables realtime monitoring of the transactions made by users, reverse monitoring, and instant notification of smooth and non-delayed transaction completions.

These settings promote users confidence by reducing both the “lost transaction” issue and the transfer transaction visibility erosion.

Layer3 Bridge is also distinguished by its ability to reliably and effortlessly solve assets chaining by users, making cross-chain transactions easier and faster for everyone.

| Pros | Cons |

|---|---|

| Seamless user interface | Limited adoption and smaller user base |

| Real-time transaction monitoring | Fewer supported assets than larger aggregators |

| Cost-efficient transfers | Limited advanced features for experienced traders |

4. Rubic

As a bridging aggregator, Rubic is capable of cross-chain asset transfer which is done in a quick, secure, and less expensive manner.

Rubic automatically makes sure that transaction fees and delays are minimized by aggregating liquidity from different bridging sources and finding the most efficient routes for the transaction.

Users are provided smooth transaction completion by auto watch feature’s capability of updating users in real time about transfer monitoring.

This capability of instant transaction updates enhances the level of reliability and transparency and reduces the risk of stuck & failed transactions.

With Rubic, the completion of intricate cross-chain transactions is effortless and secure, regardless of the skill level of the user.

Users are also able to move their digital assets with ease through the various blockchain networks.

| Pros | Cons |

|---|---|

| Aggregates multiple bridges for best routes | Fees can vary depending on routes |

| Flexible routing options | Slightly complex for beginners |

| Secure cross-chain transfers | Occasional slow execution on low-liquidity chains |

5. Relay Chain

Relay Chain brings together multiple blockchains in real time and simplifies cross-chain transactions involving digital currencies.

It combines multiple blockchains to attract the optimal and the cheapest liquidity route for its users.

Its various ‘’auto-watch’’ settings provide real–time updates on the status of cross-chain and sends updates in real time, minimizing the risk of incomplete transactions.

It enhances the accuracy and the transparency of the transactions and achieves its goal in helping users to cross-chain without complications.

It also specializes in assisting new users. Relay Chain offers users a smooth and a less complex experience in liquidating their assets.

| Pros | Cons |

|---|---|

| Efficient cross-chain execution | Relatively new in the market |

| Auto-watch monitoring for transactions | Smaller network support compared to major aggregators |

| Reliable and secure transfers | Limited advanced features |

6. MetaMask Bridges

MetaMask Bridges is a ground-breaking bridging aggregator while simplified with the MetaMask wallet. It is useful to help with cross chain spending.

It collects different directories on a blockchain to give the fastest and cheapest routes.Expedited routes are a key selling point.

Another point is the automated system which is also customizable. It lets people watch the transaction to make sure it goes smoothly.

It helps to alleviate the risk of transfer failure. This helps to bring down the stuck transfer ratio.

Transfers are stuck are high. MetaMask Bridges is very useful to people needed easy and reliable cross chain spending.

| Pros | Cons |

|---|---|

| Integrated directly with MetaMask wallet | Dependent on wallet performance |

| Easy to use and beginner-friendly | Limited advanced options |

| Real-time transaction tracking | Fewer supported chains than dedicated bridges |

7. Bungee Exchange

Bungee Exchange is at the forefront of asset bridging and is built to streamline asset transfers across chains instantly and securely without sacrificing efficiency.

Connecting to various blockchain networks allows for the fastest and most cost-effective routes for transactions.

Users can auto-watch transactions and in real-time receive status notifications to assure the transactions are completed without any lags or errors.

These features increase clarity and system dependability. The Bungee Exchange eases movement of assets across various blockchains in a simple, secure, and unrestrictive manner.

This is its greatest selling point, as Bungee Exchange attracts beginners and experts alike to help them move through the complex decentralized world of crypto.

| Pros | Cons |

|---|---|

| Fast and transparent cross-chain transfers | Limited chain support compared to larger aggregators |

| User-friendly interface | Lower liquidity on some routes |

| Auto-watch feature for transaction monitoring | Smaller ecosystem than established bridges |

8. LI.FI

LI.FI is a cross-chain asset transfer aggregator for bridging assets and it is known for being fast and reliable.

It combines blockchains to obtain the most liquid and best-priced transaction routes. Its unique feature, the auto watch, enables users to track the level of the transactions, getting instant notifications and execution without slippage.

This improved the seamlessness of the transactions and reduced the opacity and risk posture of cross-chain transactions.

LI.FI is adirect, dependable, and user-centered solution for transferring and bridging assets across multiple blockchains.

For novices and professionals of crypto it is is a critical device because it brings seamless, secure, and time-efficient bridging.

| Pros | Cons |

|---|---|

| High-speed cross-chain transfers | Some transactions may require manual confirmation |

| Secure and reliable | Interface can be complex for beginners |

| Aggregates multiple chains and liquidity | Fees may vary across chains |

9. ChainARQ

ChainARQ is a secure and efficient bridging aggregator that specializes in optimizing cross-chain transactions.

It seamlessly integrates multiple blockchains and pools the available liquidities to provide users with cost-efficient and low-latency transaction pathways.

Users with auto-watch settings can track transactions in real-time and receive immediate alerts regarding transaction status which ensures proper transaction execution with minimal risk of delays or transaction failures.

ChainARQ facilitates enhanced trustless cross-chain interactions by improving the cross-chain transaction monitoring cycle.

Users of all experience levels can take advantage of the ChainARQ platform to transfer block assets across blockchains with ease.

| Pros | Cons |

|---|---|

| Reliable cross-chain bridging | Smaller ecosystem with limited adoption |

| Real-time monitoring with auto-watch | Fewer liquidity sources than larger aggregators |

| Cost-efficient and transparent | Limited advanced features |

10. OKX DEX Aggregator (with deBridge)

The OKX DEX Aggregator (widely known as deBridge) performs de-centrally and has been tailored to optimize the cross-chain asset transfers.

With the deBridge integration, users will be able to connect to multiple blockchain networks and subtract various liquidity costs to find the fastest cost-efficient payment routes to multiple users.

In the auto watch setting, transactions can be tracked in real-time. The users get instant updates on transfer status, ensuring smooth execution and that there are no unexpected delays, thus the execution is failure-proof.

This boost the platform transparency, reliability and user confidence. With OKX DEX Aggregator, users can quickly and securely transfer assets between chains.

The cross-chain trading and bridging is straightforward, user-oriented and delivered highly efficiently.

| Pros | Cons |

|---|---|

| Aggregates multiple DEXs for best liquidity | Higher fees on certain chains |

| Strong liquidity and fast execution | Interface may be complex for beginners |

| Auto-watch monitoring for real-time updates | May require multiple confirmations for some transfers |

Conclsuion

In sum, the Bridging Aggregator with Auto-Watch streamlines real-time tracking with seamless monitoring and tracking efficiency and security with cross-chain asset transfers.

Users can easily transfer assets across numerous blockchains with optimal routes and real-time transaction updates.

This auto-watch tool is equally indispensable for crypto novices and veterans, as it guarantees swift, safe, clear, and unpartnered cross-chain movements every time with no fuss.

FAQ

A bridging aggregator is a platform that allows users to transfer assets across multiple blockchain networks. It connects different bridges and DEXs to find the fastest, most cost-efficient route for your transactions.

Auto-watch settings allow users to track transactions in real time. You receive instant notifications about the status of your transfer, ensuring transparency and reducing the risk of failed or delayed transactions.

Aggregators combine liquidity from multiple bridges, offering better rates, lower fees, and faster transfers. They optimize routes automatically for efficiency and cost-effectiveness.

Most reputable aggregators are secure, but it’s important to choose platforms with audits, strong security practices, and positive community reviews. Never share private keys.

Fees vary depending on the chains and liquidity used. Some aggregators offer discounted fees if you hold their native tokens. Always check the fee breakdown before confirming a transfer.

Got a Questions?

Find us on Socials or Contact us and we’ll get back to you as soon as possible.