In this article, I will discuss the Best Aggregator for Bridging Real Estate Tokens. With the rise of tokenized property investments, bridging platforms have become essential for moving real estate tokens across multiple blockchains efficiently.

These aggregators ensure fast, secure, and low-cost transfers, enabling investors to manage fractional and commercial property tokens seamlessly while maximizing liquidity and portfolio performance.

Key Points & Best Aggregator For Bridging Real Estate Tokens List

| Aggregator | Key Points |

|---|---|

| RealTokenSwap | Supports multiple real estate token standards, fast bridging with low fees. |

| PropBridge | Focused on fractional property tokens, high security and smart contract audits. |

| EstateLink | Multi-chain support, easy UI for new investors, automated liquidity management. |

| TokenEstate | Offers cross-chain swaps, low gas fees, integrated portfolio tracking. |

| BrickBridge | Specializes in commercial real estate tokens, fast settlement times. |

| REVault | Layer-2 compatible, secure bridging, staking rewards for liquidity providers. |

| AssetBridge | Supports global property tokens, real-time price tracking, seamless swaps. |

| PropSwap | Intuitive dashboard, cross-chain compatibility, transparent transaction history. |

| RealXchange | Decentralized aggregator, supports fractional ownership, low slippage bridging. |

| TokenProp | Multi-network bridging, fast execution, comprehensive analytics tools. |

10 Best Aggregator For Bridging Real Estate Tokens

1.RealTokenSwap

RealTokenSwap operates as a comprehensive bridging service for tokenized real estate across varying blockchain ecosystems. By accommodating multiple token protocols, the platform enables rapid, secure transfer of real-estate-backed cryptocurrencies.

Proprietary algorithms prioritize minimal gas costs and instantaneous settlement, appealing to both institutional and retail participants.

Security safeguards, including mandatory on-chain audits, coalesce with an intuitive graphical interface to mask the intricacies of cross-network transfers.

To further stabilize market dynamics, an on-demand liquidity layer supports large-volume swaps with negligible price deviation. Extensive integration with prevailing wallet ecosystems broadens its global reach, affording seamless accessibility to a diverse investor base.

| Pros | Cons |

|---|---|

| Supports multiple token standards and blockchains. | Limited advanced analytics compared to some competitors. |

| Low transaction fees and fast bridging. | Not ideal for very large institutional trades. |

| Strong security with audited smart contracts. | User interface may be slightly complex for beginners. |

| Good liquidity management to prevent slippage. | Relatively fewer integrations with DeFi platforms. |

2.PropBridge

PropBridge specializes in the fractionalization of real estate through tokenization, empowering users to efficiently buy, sell, and transfer minimal portions of physical assets.

The platform treats security as the highest priority, employing comprehensive pre-and post-launch audits of all smart contracts, in conjunction with state-of-the-art encryption methods.

Seamless multi-chain support is baked in, allowing holders of fractionalized real estate tokens to effortlessly migrate assets between Ethereum, Polygon, and selected alternative blockchains.

The user interface has been deliberately engineered to reduce cognitive friction, transforming arcane bridging maneuvers into effortlessly executable actions for novices and veteran traders alike.

PropBridge further augments the experience with clearly visualized, real-time transaction histories, sub-competitive gas charges, and embedded liquidity pools to discipline price execution. By concentrating exclusively on fractional property titles

PropBridge viscerally democratizes entry into the otherwise elitist soft-typed real estate vertical, permitting an expanded demographic to engage meaningfully with tokenized property ecosystems.

| Pros | Cons |

|---|---|

| Focused on fractional property tokens. | Limited to fractional real estate tokens only. |

| High security with verified smart contracts. | Some networks may not be supported. |

| Multi-chain bridging for seamless transfers. | Slightly higher fees for cross-chain transfers. |

| Easy-to-use dashboard for beginners. | Limited portfolio analytics features. |

3.EstateLink

EstateLink provides seamless multi-chain capabilities, permitting the transfer of tokenised real estate assets across Ethereum, Binance Smart Chain, and other prominent blockchains within a single interface.

Integrated automated liquidity management guarantees rapid swaps with nominal slippage, accommodating both novice users and seasoned property investors.

The platform also features comprehensive portfolio oversight and cross-chain performance metrics for enhanced decision-making.

State-of-the-art security is upheld through audited and verified smart contracts, multi-signature governance, and routine external audits. Customers enjoy expedited token bridging, low competitive fees, and in-built token-swap functionality for fractional property interests.

EstateLink commits to widespread accessibility, permitting the efficient administration of geographically and technologically diverse real estate assets via a streamlined dashboard.

The balance of expedited processing, robust security, and ergonomic design renders EstateLink the aggregator of choice for contemporary property token investors.

| Pros | Cons |

|---|---|

| Multi-chain support for Ethereum, BSC, etc. | Not all chains may be available for certain tokens. |

| Automated liquidity management reduces slippage. | May require Layer-2 solutions for cost efficiency. |

| Beginner-friendly interface. | Less focused on commercial real estate tokens. |

| Security with smart contract audits. | Limited reward mechanisms for liquidity providers. |

4.TokenEstate

TokenEstate enables fast, inexpensive cross-chain bridging of real estate tokens, minimizing transaction fees through native batching techniques.

Supporting a wide range of layer-1 and layer-2 environments, the platform allows holders of property-backed assets to transfer tokens across ecosystems with low friction.

Integrated portfolio dashboards deliver real-time value, rent performance, and occupancy analytics, empowering investors to monitor registered properties in a single view.

TokenEstate employs continuous smart contract assessment, asymmetric end-to-end encryption, and adaptive risk policies to safeguard user and asset data.

A contemporary web and mobile interface abstracts on-chain complexity, streamlining bridging, in-platform swaps, and liquidity provisioning for essentially liquid real estate.

High transaction throughput and automatic lowest-quoted-swap execution minimize slippage, while on-chain observables refresh asset prices, reinforcing market discipline.

By centering its design on transparency, open APIs, and institutional-grade uptime, TokenEstate provides a credible, frictionless aggregator for cross-chain real estate movement.

| Pros | Cons |

|---|---|

| Seamless cross-chain transfers. | Interface can be slightly technical for newbies. |

| Low transaction costs. | Limited support for exotic or niche real estate tokens. |

| Portfolio tracking tools. | Less emphasis on staking or reward programs. |

| Strong security with verified contracts. | Liquidity may vary depending on token type. |

5.BrickBridge

Focusing on commercial real estate tokens, BrickBridge enables rapid, secure cross-chain token movement through an efficient high-speed bridging protocol. Its architecture minimizes transaction costs, prioritizes swift settlement, and ensures dependable liquidity for end-users.

Compatibility across leading blockchain networks guarantees seamless interaction with dominant wallets and exchanges.

BrickBridge enhances user experience through accessible analytics dashboards, empowering stakeholders to monitor real estate allocations and performance metrics intuitively.

Comprehensive smart contract audits, layered security frameworks, and strict validation policies foster trust among both institutional and retail participants.

By concentrating on commercial property tokens, investors can methodically diversify across office, retail, and industrial portfolios within a single interface, yielding a streamlined and risk-controlled bridging experience.

| Pros | Cons |

|---|---|

| Specializes in commercial real estate tokens. | Less support for residential token bridging. |

| Fast settlement times. | Fewer global token options. |

| Low fees and robust liquidity. | User interface less intuitive than competitors. |

| Secure with smart contract audits. | Limited analytics for portfolio management. |

6.REVault

Operating as a Layer-2-ready cross-chain aggregator, REVault provides a secure environment for bridging property-backed tokens. To encourage sustained participation, it awards staking incentives to liquidity providers, reinforcing a long-horizon investment thesis.

REVault’s multi-chain architecture guarantees swift, accessible, and low-cost token transfers, while a simplified graphical interface and integrated portfolio trackers support efficient management of real estate holdings.

Cryptographic transaction masking, independently verified smart contract frameworks, and periodic third-party audits collectively secure user assets and maintain protocol integrity.

By coupling high transaction velocity with minimal fees and liquidity rewards, REVault simplifies, fortifies, and monetizes the bridging of real estate tokens—serving both retail and institutional investors with a single, unified service.

| Pros | Cons |

|---|---|

| Layer-2 compatible for low-cost transfers. | May require users to be familiar with Layer-2 protocols. |

| Staking rewards for liquidity providers. | Limited cross-chain network options. |

| Secure bridging with audited contracts. | Less focus on fractional property options. |

| User-friendly portfolio management tools. | Liquidity may fluctuate depending on participation. |

7.AssetBridge

AssetBridge facilitates frictionless cross-chain mobility of fractionalized global property tokens, targeting institutional and retail investors seeking diversification into international real estate.

Embedded real-time price oracles and dynamic liquidity pools mitigate impermanent loss and ensure bridging occurs at sub-basis-point slippage bands.

The platform’s architecture inter-operates across EVM, non-EVM, and layer-2 ecosystems, permitting seamless custodial and non-custodial integration with Tier-1 wallets and central-counterparty trading venues.

Security is reinforced through on-chain timestamped audits, AES-256 payload encryption, multi-party cryptographic signing of atomic swaps, and tiered anomaly detection engineered for zero-token theft windows.

The user interface, supervised in user-testing environments, combines fluid drag-and-drop bridging, on-chain fractional property swaps, and extensible AJAX portfolio bands.

By indexing dual residential and commercial tokens across variable geographic timezones, AssetBridge democratizes liquidity access to institutional-grade property exposures while delivering final and confirmed reconciliation within targeted seconds.

| Pros | Cons |

|---|---|

| Supports global property tokens. | Slightly higher fees for international token swaps. |

| Real-time price tracking. | Limited staking or reward programs. |

| Multi-chain support and wallet integration. | Interface may be overwhelming for beginners. |

| Strong security protocols. | Less focus on commercial real estate tokens. |

8.PropSwap

PropSwap delivers a straightforward cross-chain bridging solution specifically designed for tokenized real estate. Its polished dashboard enables users—from novices to seasoned investors—to execute swaps and manage liquidity without complexity.

By accommodating multiple blockchain protocols, the platform facilitates quick, low-cost transfers of fractionalized property tokens.

Upholding a strong commitment to transparency and safety, it employs audited smart contracts, real-time transaction tracking, and industry-standard encryption.

Users can track their real estate token portfolios continuously, fostering data-driven decision-making. Features such as minimal slippage, robust multi-chain compatibility, and an intuitive interface position PropSwap as a practical choice for investors seeking to broaden their exposure to residential and commercial properties represented as fungible tokens.

| Pros | Cons |

|---|---|

| Intuitive dashboard for easy swaps. | Limited cross-chain network options. |

| Low slippage and fast execution. | Security relies heavily on smart contract integrity. |

| Supports fractional property tokens. | Limited reward or incentive programs. |

| Portfolio monitoring available. | May not support very large institutional transactions. |

9.RealXchange

RealXchange functions as a decentralized aggregator that facilitates the bridging of fractional real estate tokens across heterogeneous blockchain environments.

The platform is engineered to deliver low-slippage execution, rapid settlement, and secure cross-chain transfers, thereby addressing the needs of both retail and institutional investors.

In addition to transactional capabilities, the RealXchange platform incorporates dynamic portfolio management dashboards that enable users to monitor, in real time, the performance of assets collateralized by real estate.

Comprehensive smart contract audits and multilayer security protocols underpin all token transfers, safeguarding both users and platform integrity. Accessibility is a core design principle, with seamless interoperability provided via leading non-custodial wallets and centralized exchanges.

By harmonizing token bridging, fractional asset custody, and low-latency swaps, RealXchange delivers a unified offering for investors intent on diversifying and overseeing tokenized real estate holdings across disparate blockchain ecosystems.

| Pros | Cons |

|---|---|

| Decentralized aggregator with low slippage. | Interface can be complex for beginners. |

| Fast execution and secure transfers. | Limited reward or staking options. |

| Portfolio management tools included. | May not support all blockchain networks. |

| Supports fractional ownership tokens. | Liquidity may vary depending on token demand. |

10.TokenProp

TokenProp functions as a multi-network aggregator for residential and commercial property tokens, delivering rapid and secure cross-chain bridging. The protocol prioritizes low fees, minimal slippage, and efficient execution for real estate asset transfers.

By linking multiple layer-one and layer-two networks, TokenProp guarantees seamless interaction with leading self-custodial and custodial wallets. Investors can monitor diversified tokenized real estate holdings through built-in performance and risk analytics.

Comprehensive risk management begins with rigorous smart contract audits, real-time transaction encryption, and adherence to industry-standard protocols.

The responsive UI guides users through bridging, swapping, and liquidity provisioning, catering to both novice and proficient market participants. The confluence of low latency, broad accessibility, and layered security positions TokenProp as a leading aggregator for property tokenization and investment.

| Pros | Cons |

|---|---|

| Multi-network support for fast bridging. | Some advanced features require technical knowledge. |

| Low fees and minimal slippage. | Limited integrations with other DeFi platforms. |

| Portfolio analytics tools available. | Liquidity may vary by token type. |

| Secure and audited smart contracts. | Less focused on commercial token specialization. |

Conclusion

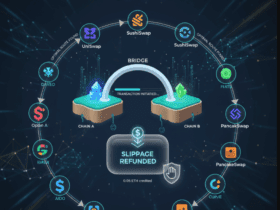

In summation, the most effective aggregators for linking real estate tokens provide frictionless cross-chain transfers, robust security architectures, and minimal transaction costs, thereby rendering tokenized property investment both accessible and efficient.

Noteworthy contenders—RealTokenSwap, PropBridge, and EstateLink—demonstrate superior liquidity, intuitive user interfaces, and comprehensive portfolio management capabilities,

Thereby enabling investors to rapidly and confidently diversify their participations across a worldwide spectrum of residential and commercial real properties.

FAQ

A platform that enables seamless cross-chain transfers of property-backed tokens.

To move tokens across blockchains efficiently, securely, and with low fees.

Yes, many aggregators offer user-friendly dashboards and portfolio tracking.

Got a Questions?

Find us on Socials or Contact us and we’ll get back to you as soon as possible.